Afreximbank Plans to Form $1B Oil Financing Platform for Guyana.

Afreximbank Plans to Form $1B Oil Financing Platform for Guyana……….In a landmark move poised to reshape Guyana’s burgeoning oil industry, the African Export-Import Bank (Afreximbank) has unveiled plans to establish a $1 billion oil service financing facility. Announced during the Guyana Energy Conference and Supply Chain Expo held from February 18 to 21, 2025, this initiative aims to bolster local participation in the nation’s rapidly expanding oil sector, aligning with the government’s local content policies.

Empowering Local Enterprises

Afreximbank’s financing facility is designed to directly support qualifying corporate clients or operate through factoring lines via local banks. This structure enables the financing of invoices from local contractors, ensuring that Guyanese businesses have the necessary capital to engage effectively in the oil industry. Professor Benedict Oramah, President and Chairman of Afreximbank’s Board of Directors, emphasized the transformative potential of Guyana’s estimated 12 billion barrels of crude oil reserves. He highlighted the importance of proactive resource management, urging Guyana to harness and build capital from its oil resources aggressively.

Economic Implications

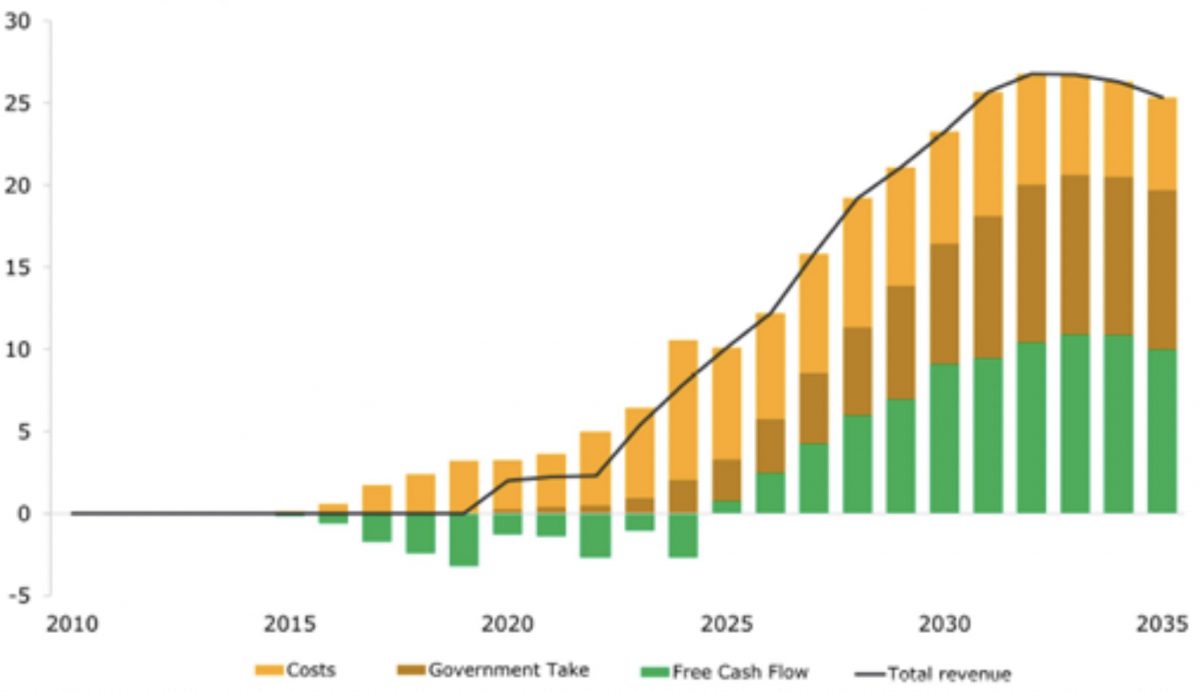

Professor Oramah provided a compelling analysis of the economic impact of retaining a significant portion of oil service activities within the country. He estimated that the oil service sector in Guyana could be valued between $5 billion to $8 billion annually. Without strategic intervention, a substantial portion of this revenue might flow to foreign oil service companies. However, by retaining just 50% of these activities domestically, Guyana’s Gross Domestic Product (GDP) could experience an increase ranging from 29% to 47%. This projection underscores the critical need for robust local content policies that empower Guyanese entrepreneurs to become significant players in the oil value chain.

Strategic Partnerships and Diversification

In the spirit of fostering Afri-Caribbean collaboration, Afreximbank is facilitating partnerships between Guyanese businesses and skilled oil service companies from African nations such as Ghana, Egypt, and South Africa. These collaborations are intended to transfer expertise, technology, and best practices, thereby strengthening Guyana’s local capabilities in the oil sector. Professor Oramah stated, “Afreximbank is there to underwrite the marriage,” highlighting the bank’s commitment to supporting these cross-continental partnerships.

Beyond immediate financial support, Afreximbank brings a wealth of experience from its extensive history of financing oil and gas activities across Africa. This experience positions the bank to offer valuable insights into managing the inherent risks associated with dependency on a single commodity. Professor Oramah cautioned against over-reliance on crude oil revenues due to market volatility and cyclicality. He advocated for diversification strategies and advised the Guyanese government to secure long-term off-take contracts with oil service companies. Such measures would enhance market access and price stability, contributing to a more resilient economy.

A Vision for Sustainable Growth

The announcement of the $1 billion oil service financing facility signifies more than just an influx of capital; it represents a strategic effort to ensure that the wealth generated from Guyana’s natural resources translates into sustainable economic development for its citizens. By focusing on local content and fostering international partnerships, Afreximbank’s initiative aims to create a thriving ecosystem where local businesses are integral to the oil industry’s value chain.

As Guyana stands on the cusp of an economic transformation driven by its oil reserves, the collaboration with Afreximbank offers a pathway to harness this potential responsibly. The emphasis on local empowerment, strategic partnerships, and economic diversification lays a robust foundation for Guyana’s journey toward sustained prosperity.

In conclusion, Afreximbank’s $1 billion financing platform is poised to be a catalyst for change in Guyana’s oil sector. By empowering local enterprises, fostering strategic international collaborations, and advocating for economic diversification, this initiative aligns with Guyana’s vision of leveraging its natural resources for inclusive and sustainable development.

Leave a Reply